Meet Cleo Review – Meet Cleo, is it an AI financial fairy godmother?

Money Hacks Article

Meet Cleo Review – Meet Cleo, is it an AI financial fairy godmother?

So, Meet Cleo, you want to know if it’s any good. If it is a financial fairy godmother?

In short, it is a super smart fintech boffin that will help everyone understand their money better!

From those who are too casual with their cash (i.e. me) to those who are financially astute, Meet Cleo will give you insights that will help you keep on top of your cash. So helping you stay out of your overdraft or manage your savings better.

Below is my full Meet Cleo review, but before you read that, you might as well sign up for free, and get £5!

Get £5 right now when you sign up for free.

Meet Cleo Review

The age of super smart robots is coming! It’s looking less Terminator and more Hitchhiker’s Guide to the Galaxy.

The number is 42, by the way.

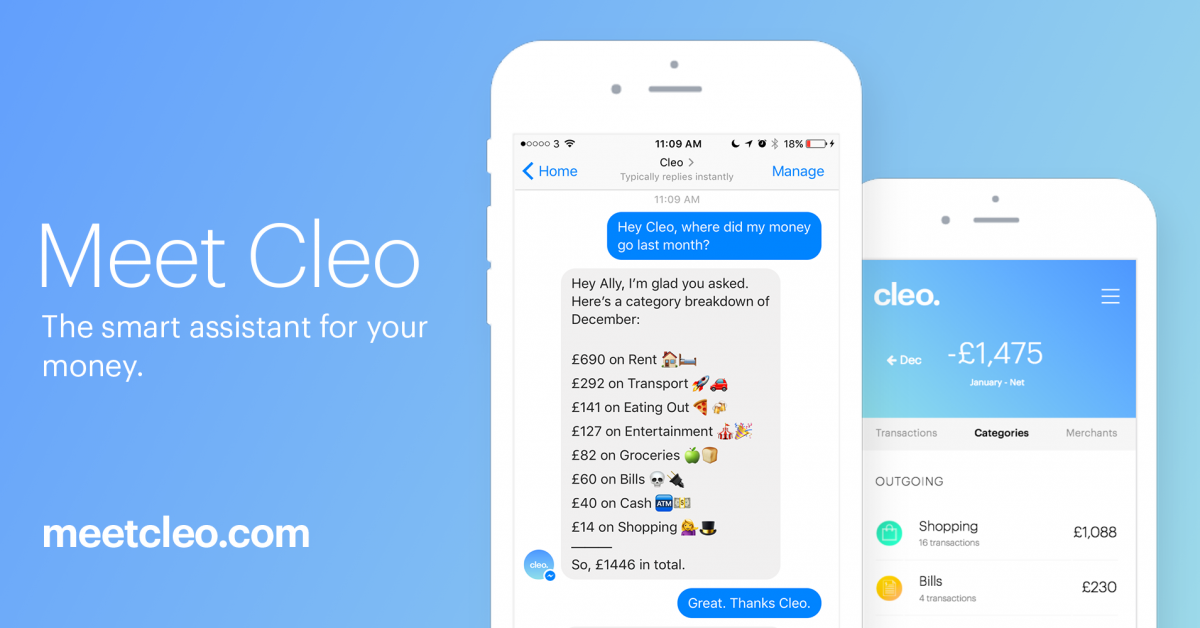

Ok, back to my Meet Cleo review. Yes, so, Artificial Intelligence is here. Well, narrow AI is here. Cleo is a form of narrow fintech AI and takes the form of a chatbot to help you manage your finances.

Cleo’s story so far

Born in 2016 at the startup accelerator, Entrepreneur First, Cleo’s small team now has some big name backers including Niklas Zennstöm (Founder of Skype) and Simon Franks (Founder of Lovefilm).

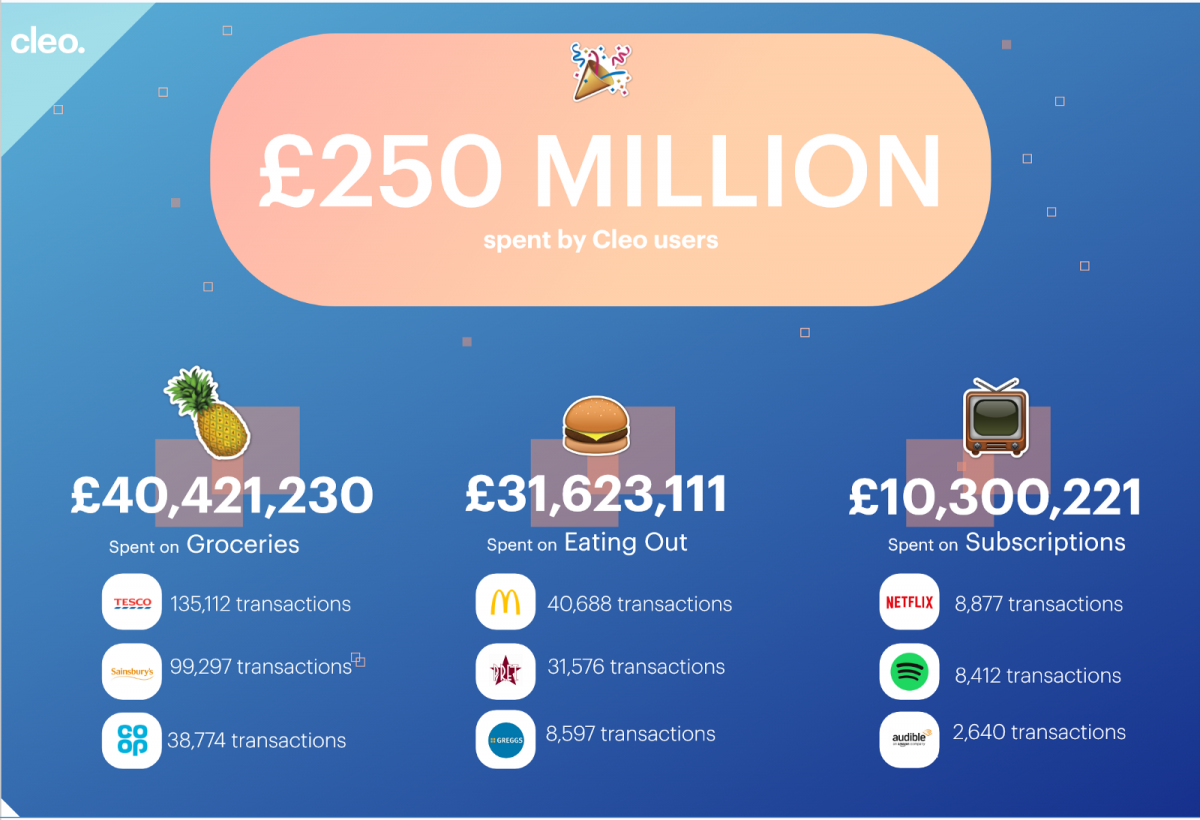

Since then it has helped Cleo users manage £250 million worth of spending.

What does Cleo actually do?

Cleo analyses your finances through securely accessing your transaction data. It then uses its super smart AI-powered brain to scan your transaction history, calculating and spotting interesting spending trends, habits and lets you keep track of budgets.

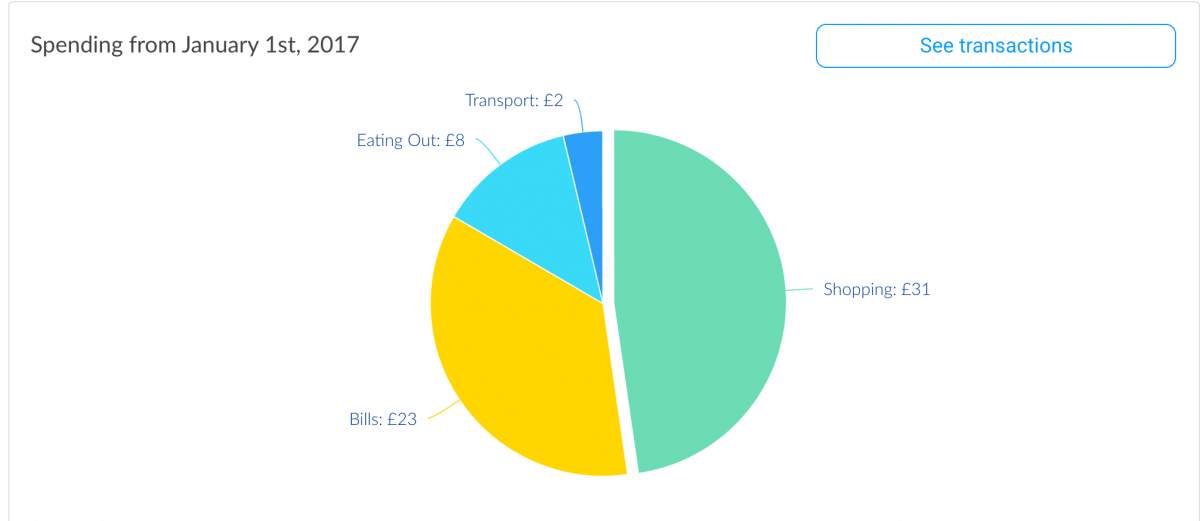

You can also view your balance, check direct debits, latest transactions, and see your spending per category.

So, simply put, it looks at your finances and gives you insights.

Features of Cleo

There are 6 big features of Cleo that are worth looking at in this review.

Talk to Cleo like you would a friend

There’s no need to be super fancy or super formal when you talk to Cleo. You can chat to it on Facebook Messenger or by SMS Text. Soon you’ll be able to use Cleo via Amazon Alexa and Google Assistant.

Check Your Balance Instantly

Just chat to Cleo and ask for your balance, you’ll get an update in an instant.

Set Budgets

Talk to Cleo about setting a budget, and she’ll suggest a budget based on your finances. You can change it whenever you want, just ask.

Get A Detailed Breakdown

Cleo does all the hard accounting work for you, by auto-categorising your transactions, bills and direct debits. In an instant, Cleo can figure out what money managers would take days to do. She’ll even present it to you in a beautiful, easy to understand manner.

Receive Smart Spending Advice

Once Cleo learns enough about your spending habits, she will advise you on where you can cut costs. Whether it’s a bothersome bill or an overpriced subscription, Cleo uses technology to get you the best deal.

Manage Money Better

With all of this information at your fingertips, you will be better equipped to make smarter financial decisions. The ease of use, clear presentation and smart insights that Cleo offers means that nobody should be confused when it comes to their finances.

Cleo’s security and all that stuff

Cleo is pretty darn secure. No data in the world can be 100% secure. The only way that can happen is if you can never access that data and that’s useful to nobody, but Cleo is very secure and safe.

Read-only mode

Cleo only accesses your data in read-only mode so can never edit or delete data.

Never story banking or login details

Yup, Cleo never stores your banking or login details.

Encryption, encryption, encryption

Cleo uses certified bank-level 256-bit encryption to connect to the service and to the servers.

How does Cleo make money?

It never sells your data. That’s the big thing here. Cleo will make money selling cheaper, better financial products.

There is also soon to be a big shift in financial data access where regulation is pushing banks to make data open to third-party’s so that banks and financial institutions do not have a monopoly, there is a big opportunity for Cleo to become a user interface for user’s financial products. This means big bucks for Cleo but also will help democratise banking and financial products.

Is it worth getting Cleo?

After using it for a few months, I do like getting notifications on my spending and insights in to what I am actually spending a few quid here and a few quid there on. It seems I do spend a lot more money than I thought I did and Cleo made me aware of just what that was.

So my conclusion of this Meet Cleo AI review is… Yes, if you want free intelligent insights into your money, finances, and spending, then Cleo is definitely worth getting.

Get £5 right now when you sign up for free.

FAQs

Answers to your questions

Here are some answers to questions I get asked most about from this article, Meet Cleo Review – Meet Cleo, is it an AI financial fairy godmother?. I'll try my best to answer any relevant questions that get sent to me when I can. If you have any questions just drop them in the comments below.

Is Cleo safe and secure?

Cleo has a £85k security pledge where they will cover that amount which is equivalent to the FSCS deposit and savings guarantee. They also use 256-bit encryption and have similar security practices to banks.

Is Cleo free?

Yes. Cleo is completely free. No charge for users.

Comments

Take part in the discussion

Discussion about Meet Cleo Review – Meet Cleo, is it an AI financial fairy godmother? article, if you have any questions, comments or thoughts then get leave a reply.