Making Tax Digital and FreeAgent: What does it mean for you?

Business & Indie Making Article

Making Tax Digital and FreeAgent: What does it mean for you?

What is Making Tax Digital?

Making Tax Digital, is an initiative by the UK Government to transform the tax system and get rid of the tax return by 2020. With the aim to make the tax system full digital.

Why bother?

The UK Government wants to make the tax system more efficient, more effective, and easy for taxpayers. The are essential 4 benefits as per the FreeAgent whitepaper ‘Guide your clients through Making Tax Digital (pdf)‘:

- Know where you stand – with a full picture of your business’s tax affairs in your digital account.

- Save time – by having access to all your business’s tax info in a single place.

- Save hassle – by managing all your business tax affairs online.

- Plan and budget more effectively – with a real-time calculation of how much tax you owe.

What’s actually changing?

The current plans are that:

- Traders with total income under £10,000 will be exempt from Making Tax Digital.

- Taxpayers will send summaries to HRMC of their income and expenditure, at least 4 times a year.

- Cash basis accounting will be available to more taxpayers.

What’s the timeline for changes?

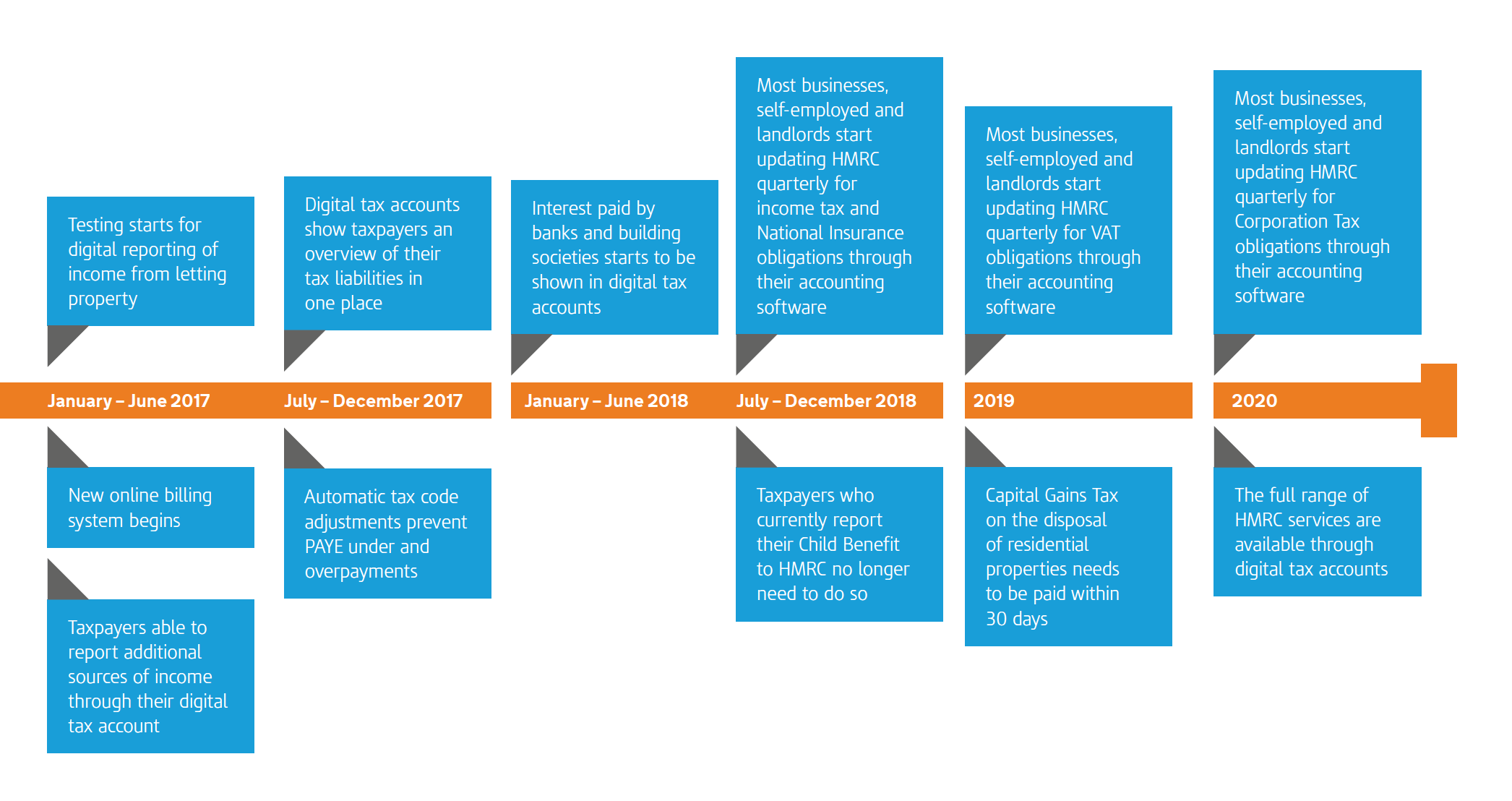

Making Tax Digital started a phased roll out 2016 and aims for completion in 2020. Below are a couple of timeline excerpts from the UK Gov document – Making Tax Digital: A Roadmap (pdf).

The key milestones from this timeline are:

- July – December 2017 – Digital tax accounts show taxpayers an overview of their tax liabilities in one place’.

- July – December 2018 – Most businesses, self-employed people and landlords start updating HMRC quarterly for income tax and national insurance obligations through accounting software.

- 2019 – Most businesses, self-employed people and landlords start updating HMRC quarterly for VAT obligations through their accounting software.

- 2020 – The full range of HMRC services is available through digital tax accounts.

What does this actually mean for me?

As of the current understanding. You will need to start sending tax summaries from 2018 to HMRC via digital tax accounting software. HMRC will not provide this software. That means you will need software such as FreeAgent to submit this information to HMRC.

Is this even achievable?

The UK Government says it is achievable by 2020. However, not everyone agrees, such as the 76% of tax professionals in a survey revealed by Brewer Morris.

More information on Making Tax Digital

You can find more information about Making Tax Digital on the UK Gov website and on FreeAgent.

Comments

Take part in the discussion

Discussion about Making Tax Digital and FreeAgent: What does it mean for you? article, if you have any questions, comments or thoughts then get leave a reply.